Solar Power and the Vegan Movement: A Unified Path Toward a Better World

The main goal of the Vegan Investing Club is to create a better world, $100 at a time by investing

The main goal of the Vegan Investing Club is to create a better world, $100 at a time by investing

Why the Vegan Investing Club is Temporarily Limiting New Memberships and Crowdfund announcements to U.S.Based Vegans You may have noticed

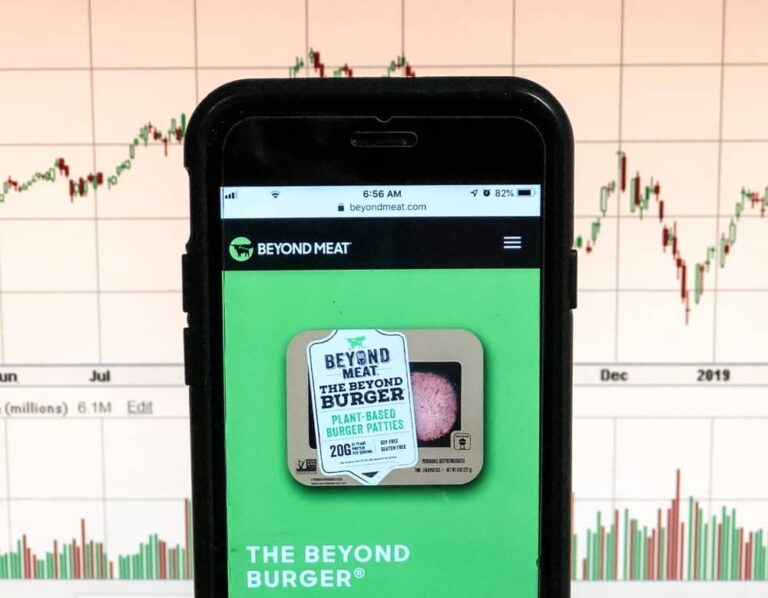

In recent years, the world has witnessed a surge in interest in veganism and plant-based living. With it, a higher demand

Sustainable investing, once considered a niche strategy, has rapidly gained prominence in the world of finance. Beyond traditional financial metrics,

Investment in vegan businesses is accelerating. Here are the areas it’s growing in and how businesses can find investors. As