We have passed 29,000 members and announced 27 companies. Some members use a strategy of investing an equal amount in one company a month to create a diversified portfolio.

Pizza

Mac n Cheese

Desserts

Products

No Dairy

Detection

Dips & Falafel

Solar Systems

Snacks

Energy

Meat Products

Building Material

Bacon

Vegan Startups

Protein Powder

Snacks

Fur

Plastic Products

Burgers

Vitamins

From Air

Energy Drinks

Tech

Recharging

buckwheat tortilla

We Support these Ongoing Crowdfunds

Aquipor

Green Concrete Technology

Concrete is the second most common material in the world, and concrete surfaces such as streets, sidewalks, and parking lots are impermeable to stormwater, contributing to massive amounts of stormwater runoff pollution and urban flooding in cities.

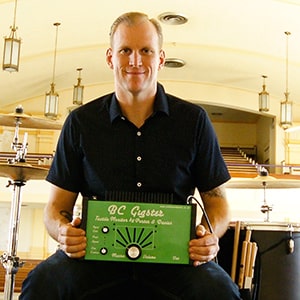

GoSun

From Portable Solar Solutions to Powering Electric Vehicles

GoSun is aiming to revolutionize the solar industry and the electric vehicle (EV) charging landscape with its innovative, smart technology—empowering individuals to live more independent, resilient lives. Its newest innovation, the EV Solar Charger, is designed to address one of the EV market’s biggest challenges: reliable, sustainable charging.

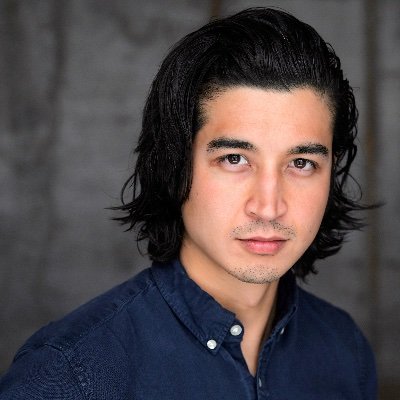

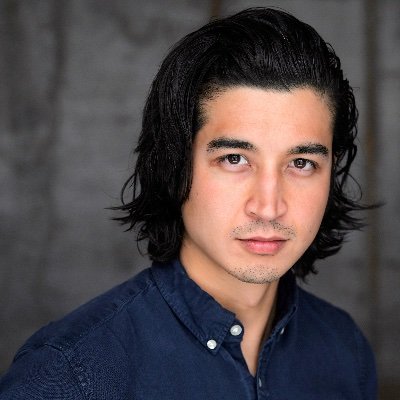

MAKA

The Best of a Green Juice and an Energy Drink, in One Award-Winning Brand

MAKA is an award-winning organic, plant-based energy drink that tastes amazing. We made wheatgrass craveable, and now we’re scaling with fresh operations & supply chains, a new flavor drop, and a focused plan to get clean, plant-based energy on every shelf (and in every fridge).

PACHA

A rapidly growing organic CPG brand fueled by a super-seed: sprouted buckwheat

Our sprouted buckwheat bread is made from just 2 ingredients + organic herbs and spices. No gums. No fillers. No BS. And now, we’ve taken that same clean, gut-friendly magic and made what we believe is the first-ever sourdough buckwheat tortilla and bread.

Back the Impact & Plant-based economy!

We are taking reservations now

This site can help vegan consumers invest in products and companies they love. It's conscious economy coming to life. I love it!

– Esther Bertram, Founder of In Vegans We Trust

See who endorses our Club

Founder

"Businesses need startup money and that could be the hardest to get."

Director

and

and

"I'm super excited about the Vegan Investing Club because I wanna support Vegan businesses and I want to see them thrive. To invest in a Vegan startup that has a mission of sustainability, health consciousness, or more compassionate living is where I want to put my money."

Publisher & Co-founder

"I love what you're doing, and with your expertise, drive, and passion ... VegNews wants nothing more than ... to help you get there."

Founder

“... This Club helps entrepreneurs raise money through Crowdfunding and connects vegan advocates with opportunities to invest in early-stage startups that are making a positive impact on the world. This is a win-win for everyone involved …”

Founder

Founder and Fund Manager

"I could see that gaining ... traction.”

CEO

"We raised capital last year, with the help from Vegan Investing Club. I can't say enough about the organization. I strongly urge anyone who's interested in their mission and also getting good investor returns should join this club."

President

"The Vegan Investment Club is a great way to support the vegan entrepreneurs who are among the brightest hopes for creating a sustainable, compassionate world. I wholeheartedly endorse the Club’s efforts and invite all like-minded members of the vegan community to become part of the Vegan Investment Club."

Founder

Olympic Athlete Record Holder and Anti-dairy Activist

“How wonderful and empowering is it that a platform has been developed to allow even the smallest of investments into the world of vegan living. As we begin to guide our financial decisions with our souls, we become free and our truest authenticity rises above all else. This platform is a game changer.”

Vegan Ironman and

Athlete

"Everybody knows veganism is the future like- everybody! A way for, you know, smaller companies to be able to access funding and investors to be able to ride the wave."

Vegan Musician

"Check out the Vegan investment channel(Club) whereas for as little as $100, you can not only support young upstart vegan companies, but you will actually become part of the vegan economy where we will change the world."

Vegan Actor on

"Hey guys I'm absolutely loving this new Vegan channel(Club). If you want to change the world to make a major impact, check it out for yourself."

Vegan Bodybuilder and

Actor

"This is a great opportunity to support vegan companies. If you're vegan and looking to make an investment that actually matters, this is the way to do it."

Founder

Film Documentary

and

"These companies will have values that the investors and customers want, so it’ll be more aligned and, hopefully, end up with better products and services in the market."

Founder & President

"It's wonderful how they are able to empower small and medium-scale investors AND new vegan companies from the start. We need a strong vegan economy to create a compassionate vegan world. The Vegan Investing Club is accelerating both."

Fund Manager

and

and

“Crowdfunding lets anyone invest in startups they love and be part of the solution that we all wish to see.”

CEO

Oshi (formerly Plantish)

Vegan Salmon

“This Club enables the 95% to invest just NIS 350 in Israel’s amazing foodtech startups. Now anyone can be part of change, with a chance for a profit.”

Founder

"We worked with Mark and his team in one of our equity crowdfunding campaigns, and we actually raised quite a lot of money from the Vegan Investing Club."

Founder

Businesses need startup money and that could be the hardest to get.

Director

and

and

I'm super excited about the Vegan Investing Club because I wanna support Vegan businesses and I want to see them thrive. To invest in a Vegan startup that has a mission of sustainability, health consciousness, or more compassionate living is where I want to put my money.

Publisher & Co-founder

I love what you're doing, and with your expertise, drive, and passion ... VegNews wants nothing more than ... to help you get there.

Founder

“... This Club helps entrepreneurs raise money through Crowdfunding and connects vegan advocates with opportunities to invest in early-stage startups that are making a positive impact on the world. This is a win-win for everyone involved …”

Founder

Founder and Fund Manager

"I could see that gaining ... traction.”

President

The Vegan Investment Club is a great way to support the vegan entrepreneurs who are among the brightest hopes for creating a sustainable, compassionate world. I wholeheartedly endorse the Club’s efforts and invite all like-minded members of the vegan community to become part of the Vegan Investment Club.

Founder

Olympic Athlete Record Holder and Anti-dairy Activist

“How wonderful and empowering is it that a platform has been developed to allow even the smallest of investments into the world of vegan living. As we begin to guide our financial decisions with our souls, we become free and our truest authenticity rises above all else. This platform is a game changer.”

Vegan Actress

What's so exciting about V.I.C. is that it provides this lower barrier to entry for so many more people to start investing, and investing in companies that they believe in and that align with their values.

Vegan Ironman and

Athlete

Everybody knows veganism is the future like- everybody! A way for, you know, smaller companies to be able to access funding and investors to be able to ride the wave.

Vegan Musician

Check out the Vegan investment channel(Club) whereas for as little as $100, you can not only support young upstart vegan companies, but you will actually become part of the vegan economy where we will change the world.

Vegan Actor on

Hey guys I'm absolutely loving this new Vegan channel(Club). If you want to change the world to make a major impact, check it out for yourself.

Vegan Bodybuilder and

Actor

This is a great opportunity to support vegan companies. If you're vegan and looking to make an investment that actually matters, this is the way to do it.

Founder

Film Documentary

and

These companies will have values that the investors and customers want, so it’ll be more aligned and, hopefully, end up with better products and services in the market.

Founder & President

It's wonderful how they are able to empower small and medium-scale investors AND new vegan companies from the start. We need a strong vegan economy to create a compassionate vegan world. The Vegan Investing Club is accelerating both.

Fund Manager

and

and

“Crowdfunding lets anyone invest in startups they love and be part of the solution that we all wish to see.”

CEO

Oshi (formerly Plantish)

Vegan Salmon

“This Club enables the 95% to invest just NIS 350 in Israel’s amazing foodtech startups. Now anyone can be part of change, with a chance for a profit.”

Companies that members invested in

after the club emailed a link

Crowdfund platform : Wefunder

“As a startup founder it’s gratifying when the crowd invests because it means they support our mission and believe they can make a profit with us.”

Crowdfund platform : Wefunder

A Vegan protein powder from the makers of ‘The Game Changers’

Crowdfund platform : Republic

"We love that investors from the Club invested and we expect them to become some of our most passionate customers."

Crowdfund platform : Wefunder

“Once customers taste our delicious vegan foods they fall in love and Club members understood this because they invested to help more people enjoy plant-based.”

Crowdfund platform : Wefunder

“Vegan Investing Club was a rapid response team for our funding needs during early 2022. Their investors helped to quickly push us past our funding plateau to a successful Reg CF Campaign. VIC was the solution that we needed right when we needed it most!”

Crowdfund platform : Wefunder

“Club members were great they helped push our Crowdfund over the million dollar mark.”

Crowdfund platform : Wefunder

“We’re strongly mission driven and the members of this Club responded by investing in our Crowdfund. We’d certainly do it again.”

Crowdfund platform : StartEngine

"Mark, the founder of the Club, came to see a PowerBloc system at our latest installation and had a chance to speak with the customer..."

Crowdfund platform : StartEngine

GTFO is primarily known for selling known vegan brands, & they create some products.

Crowdfund platform : StartEngine

A company that creates cruelty free clothing.

Crowdfund platform : Wefunder

A community for conscious entrepreneurs & innovators solving the world’s biggest problems.

Crowdfund platform : Wefunder

A company that creates Vegan pizzas and wings

Crowdfund platform : Republic

A Vegan company bringing healthy snacks to hospital vending machines

Crowdfund platform : Wefunder

“We craft elegantly nostalgic, nutrient-dense desserts that satisfy sweet cravings and nourish wellbeing.”

Crowdfund platform : Start Engine

“PLNT Burger offers a delicious, sustainable solution that's better for human health, animal welfare, and our planet.”

Crowdfund platform : Wefunder

“Hempitecture's mission is simple: we manufacture healthy, non-toxic biobased insulation for People and Planet.”

Crowdfund platform : Wefunder

One of the first clinical labs to enter the fast-growing Multi-Cancer Early Detection (MCED) market, we feature a high quality, affordable blood test that outperforms other competitive technologies..”

Crowdfund platform : Start Engine

Drawing moisture directly from the air, Kara transforms the invisible into the essential—delivering a continuous supply of premium-quality, mineralized water.”

Crowdfund platform : Wefunder

At MAKA, we are all about making a difference: MAKA's sustainably focused business practices ensure that we're kind to the planet. It's a triple win—doing good, living green, and feeling great!

Join the Club.

- Learn how equity Crowdfunding works.

- Gain insights from fellow members.

- Get notified about exciting Impact & Plant-based companies.

Watch your inbox for emails announcing new companies.

Invest and spread the word to your friends.

Cheer your companies on and exit.

members joined to date

0

“The earlier you get in, the more upside you capture — but only if you get it right.”

Marc Andreessen, Co-founder of Andreessen Horowitz

Who started the Club & why ?

Catalyze the Impact & Plant-based economy

Current animal-based production and market practices are wasteful and unsustainable. A pound of beef can take 1,800 to 4,000 gallons of water to produce. According to the Water Footprint Network, the average water footprint per gram of beef protein is six times larger than for legumes. The future is vegan. It’s time to invest in sustainable, humane food production.

Source: Forks Over Knives Film

Maximize your impact by joining the Vegan Investing Club.

Our Transformative Journey:

Accelerating the Impact & Plant-based Economy

We’re a group of vegan entrepreneurs and social impact advocates who believe that the world needs more plant-based companies to lead the charge in environmentally and ethically-responsible ways. Our vision is to unite like-minded people to accelerate a vegan economy through equity Crowdfunding campaigns, irrespective of the amount individuals are able to invest. There’s power in numbers and the most powerful way to make a big difference is through unified action.

2020-2021

Phase 1

11,676 members joined the Club to receive announcements of the first vegan companies.

2020-2021

2021-2023

Phase 2

Announced 10 companies in this phase and members invested. Membership grew past 20,000.

2021-2023

2025 & Beyond

Phase 3

Grow towards a million members so the club can provide all money needed by Impact & Plant-based startups to penetrate the market.

2025 & Beyond

The people behind the Club

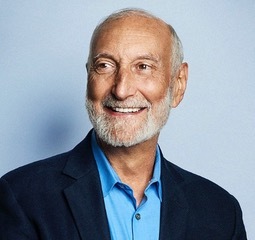

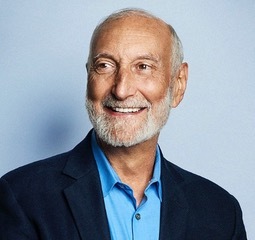

Mark Perlmutter, Founder

Mark has been innovating to make the world better most of his career. He founded the Vegan Investing Club to accelerate the vegan economy by tapping the amazing potential of Crowdfunding.

He hosted and produced the Crowdfunding World Summit promoting this idea to 12,000 attendees through interviews with 75 speakers including Senators, regulators and international industry leaders. Later he lobbied the SEC on rules governing this new law.…

Then he created a food company making vegan meals delicious enough so that even non vegans enjoy them. He has a plan to match meals to customer microbiome and DNA for maximum health benefits. He funded a film showing six diabetics reversing their disease in 30 days on a vegan diet: “Simply Raw”. Seen by millions this led him to make a dvd series: “Raw For Life” with 30 vegan celebrities teaching the vegan lifestyle.

In the early days of the internet, he created DirectIPO, one of the earliest sites for raising money online long before the Crowdfunding laws were passed.

As a college student, he produced a solar energy exposition at the University of Denver and this led him to become a green business advocate. This was also when he stopped eating animals.

After the Crowdfunding laws were passed, he spoke at the Silicon Valley Crowdfund Conference and the Global Crowdfunding Expo. He’s been quoted in the Wall Street Journal, Business Week and Fortune. He had a long career as a licensed investment broker and before that as a real estate broker.

Mark splits his time between Maryland and Lima, Peru. He loves meeting people and any kind of physical fitness: bicycle riding, hiking, yoga, the gym, swimming. He’ll go anywhere for a meal with other vegans. He enjoys long form podcasts on biology, neurochemistry, and spirituality. He and his fiancé live together near the cliffs above the Pacific ocean. They enjoy preparing vegan meals for friends. For the first time he lives with cats – he’s sure he prefers dogs.

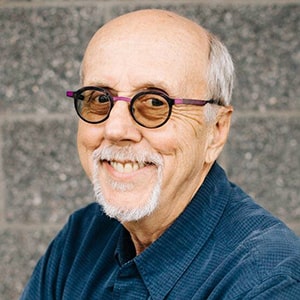

Advisors

“Now we can all be part of accelerating the vegan economy … ” Read More

“The reason I’m so excited to be part of the Vegan Investing Club is that it brings together passionate vegans and bold, early-stage companies promoting vegan products and services in a unique and very simple way. Now we can all be part of accelerating the vegan economy in addition to the other thoughtful ways we live and advocate for a vegan lifestyle that is so necessary in our world today.”

Saurabh Dalal - Vegan activist, Investor, Humanitarian, Board member of multiple Vegan organizations & Societies

Saurabh Dalal - Vegan activist, Investor, Humanitarian

Saurabh enjoys being involved in outreach, education, and greater advocacy of sustainable vegan diets and Ahimsa (non-violence) as compelling solutions to many global problems. Saurabh is a lifelong vegetarian and ethical vegan since 1991. He volunteers in various capacities and leadership roles for numerous vegan and animal rights organizations including the International Vegetarian Union and the Veg Society of D.C. He identifies as a Jain and has been active in the Jain community locally and internationally.

Saurabh is a longtime ethical investor and pursues ways to incorporate vegan values into investments. He works as an engineering consultant on the next generation of emergency communications systems, holds graduate degrees in Physics and Engineering, and explores ways of integrating sound science into related areas of his activism and passions.

“Am thrilled to see this Club working so well … ”

Read More

I’ve known Mark for years and am thrilled to see this Club working so well — it has more potential to accelerate the vegan economy than anything I’ve ever seen.

Eilene Cohhn - Board Member of PETA

Eilene Cohhn - Board Member of PETA

As a Board Member of one of the largest animal rights organizations, Cohhn has organized numerous fundraising events with Vegan celebrities including Paul McCartney, Sarah McLaughlin, the B52s, Jane Goodall, more. Almost single handed she brought millions of dollars and international coverage to the animal compassion movement.

Mentions, endorsements, & partners

The vegan economy is rising

Frequently Asked Questions

It’s a free-to-join community where vegans come together to learn from each other about early-stage investing and aligning your money with your values. Club members get email announcements about opportunities to invest sometimes, starting at just $100 in exciting vegan companies. The goal is to accelerate the vegan economy and do well by doing good.

It was started by Mark Perlmutter, a vegan entrepreneur whose first career was in the investment industry. He then used his experience to start a vegan film company, a vegan convenience food company, and now the Vegan Investing Club. After consulting former Wall Street colleagues on the best way to fund his vegan food company and take it all the way to IPO, he found no clear path. Vegan companies rarely go the route of IPO or acquisition like many Silicon Valley tech startups, so if prospective investors don’t see an exit strategy it’s hard for the entrepreneur to raise early-stage money. So he designed a 5-year plan for his food company to scale and go public which would exit its early investors at a great profit. When he told his colleagues they remarked that so many vegan entrepreneurs also need a plan like this. And they asked could it be templated?

With feedback from eight vegan leaders and influencers a template including a way to raise early money was created. And poof ….. this Club was born. The Club was announced on July 15, 2020 by Happy Cow’s founder Eric Brent to members of his site and then ads were run to gather members.

It grew from the solution for one vegan entrepreneur, into a Club to support hundreds of vegan entrepreneurs over the coming decades. The goal is bringing together tens of thousands of vegan advocates to accelerate the vegan economy by each investing small amounts in promising startups.

Members share a mission: “to make the world more vegan by growing the vegan economy.” By applying best practices from the investment world we can succeed.

Join for free and start learning about vegan Crowdfunding opportunities. The Club has several social channels including a Facebook group. Members discuss how to align their savings with their values and expand the vegan economy. After you join you’ll hear from other members who have already invested in vegan Crowdfunded companies. As a Club member, you’ll receive email alerts of vegan startups doing Crowdfundings on regulated Portals. And if discounts or bonus shares are offered, you’ll know.

No. Investments are not made on this site. The Club simply notifies members as soon as a vegan company announces an offering that follows the Club template and if there are early-bird specials. The first notifications were in Phase 2 and those were successful. We’re now in Phase 3 and announcing more companies. So after joining you’ll begin getting announcements.

Once you get an announcement, you link to the regulated Crowdfund Portal to view details of the company. If you choose to invest, that is where you will make your investment.

All companies announced by the Club will be in the early-stage and raising money on a regulated Crowdfund Portal where it is legal for anyone & everyone to invest. As investors ourselves, we like to see companies with a defined exit strategy, a smart use of funds, some traction or a compelling idea, a reasonable valuation, bonus shares for early investors, and allowing investors to start with $100.

Previous to the Crowdfunding laws, early-stage opportunities were not available to 98% of the public. Through the Club, tens of thousands of vegan advocates and small investors will be notified when young vegan companies are available for them to invest in.

Inevitably, member discussions in the Club’s Facebook group and LinkedIn group include public vegan companies. But our Club’s purpose is to notify members about young startups raising early funds via Crowdfunding. And our educational efforts will address the how to’s of Crowdfunding.

Investing early before a company goes public can be lucrative. But it requires access to early-stage deals. The Crowdfunding laws allow every American to view opportunities previously reserved for about 2% of us.

Our Club is advised by vegan leaders with many years in the vegan movement. We will continue evolving to help advance the vegan economy and that may someday include announcements of public companies.

Member engagement is encouraged & necessary for best learning. Please share & participate! Everyone welcomes relevant questions and answers from other vegans. There are no wrong questions.

If you have a private question don’t hesitate to email us at Hello@VeganInvestingClub.org or use our contact form on our website.

No. We are neither. No transactions take place on our Club’s site.

We simply notify members of vegan Crowdfund offerings posted on Portals and suggest interested members link to view the offering. As such we are not licensed by the SEC.

We are in Phase 3 and companies planning a Crowdfunding on a Portal can contact us. We can suggest a 5-year funding plan recommended by our Advisors. It’s suitable for scalable companies and culminates in an IPO or acquisition to let early investors and founders exit.

In the near future, we hope to have an array of helpful resources available for all kinds of vegan companies.

When a Crowdfund company gives free shares to investors as an incentive in the early-bird period, these are known as Bonus shares. This is one of things we like to see in a company.

The Club does not evaluate or do due diligence on companies. We do not have the expertise for that. Crowdfund Portals and broker dealers may do that. Rather, we simply notify members of vegan companies raising funds on a Crowdfund portal that we love their product or service, or believe their success would make the world better.

Once a member receives our email alert, the rest is up to them.

If they visit the Portal to view the company’s Crowdfund offering, and wish to invest they must do it on the Portal.

We do not charge members any fees.

Instead we collect a per member fee from companies for announcing their Crowdfunding to members.

We use these fees to accelerate the vegan economy, for ads to attract more members, website, writing time, email SaaS services, research, and other operating costs of the Club. Every announcement includes this disclosure.

We are gathering thousands of vegan advocates to act in unison for a more vegan world.

Yes, investing in young companies is risky. Conventional wisdom teaches that diversifying into ten or more startups each year can be wise. This may increase the chances of one big win to make up for others that don’t succeed. If one of your early-stage companies is a success, it may be enough to pay for the others that are not. When investing in young companies, taking advantage of early-bird discounts and Bonus shares can be important.

Disclaimer:

When Investing your funds are at risk. So read the full offering information on the Crowdfund Portal before making up your mind. The Club does not give advice. Our communications are just notifications of public information displayed on registered Portals. If you have any questions about our club, reach out to us.

Disclosure:

Our Club has best practices in transparency with you, our members, as we pursue our mission of growing the vegan economy. We want you to know we receive fees from companies for announcing their Crowdfunds to members. We choose these companies because we believe they can help accelerate the vegan sustainable economy. You make your own decisions on each company you learn about from us. We do not receive commissions, we do not handle your funds, and we do not charge you fees. We use such funds to attract members, for email & hosting services, social media writers, and website. The amount we receive varies and is related to the number of members at the time of our agreement with the company. Once you receive this announcement you must link to the regulated Portal to see all the offering information. That’s where you can invest if you like. The Club does not receive a kickback if you invest. We are happy when vegan startups receive backing to expand. This furthers our goal to accelerate the vegan economy.

We want you to know that we love the products & services of the companies we announce. We do not choose companies just for the fee. We announce companies that we believe can make a difference. Our operating costs are low enough that we can be extremely selective and still be financially sustainable. The Club will tell you about companies whose products and services we respect. That being said, you must make your own decision about whether investing is appropriate. When investing, you assume all risk, and agree that the Club is not liable for, nor does it have the ability to determine the outcome of any company that it shares with you.

The Club follows best practices in accordance with regulations including 17(b). When we receive a fee to send an announcement, we disclose the amount with the announcement. Thank you. 10/14/23